Freight market report – February 2022

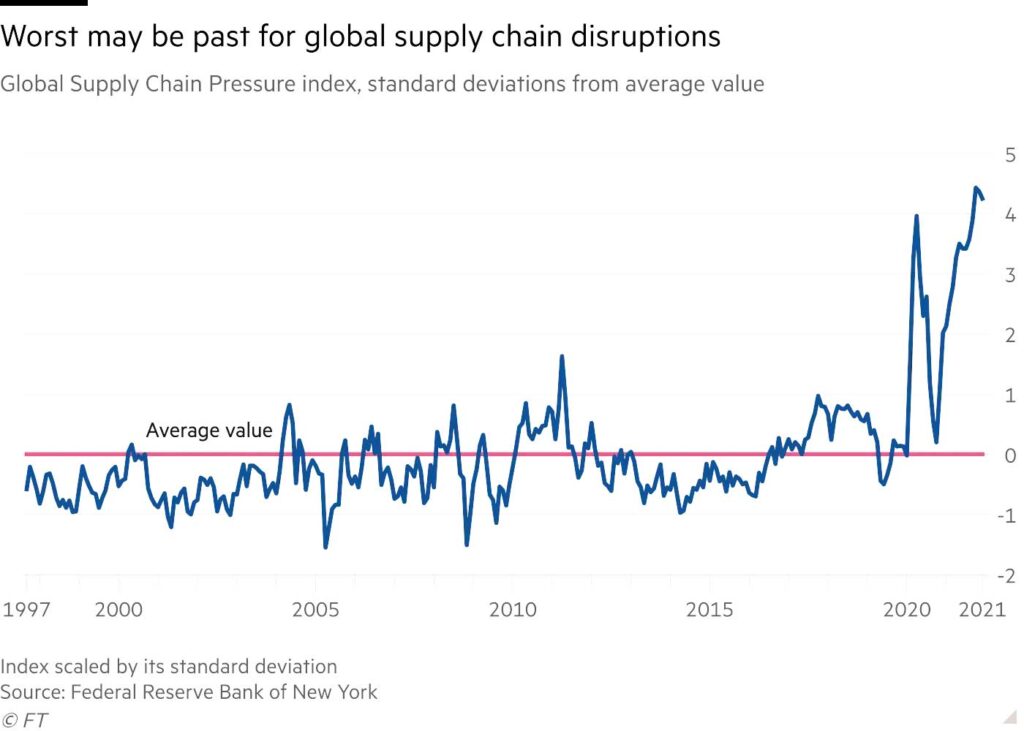

Supply chain pressures remain well above their pre-pandemic levels, on all modes, with 2022 starting pretty much as last year finished, but there are indications that disruption may soon start to recede and analysis by the Federal Reserve Bank of New York is raising faint hopes that global trade could start to normalise this year.

Last year was a perfect storm for supply chains, with COVID disrupting global production, at the same time as the impact of the pandemic boosted consumer demand and while some trade lanes seem to be improving, many are still dealing with pandemic-related pressures, factory shutdowns and logistics bottlenecks.

The Suez Canal closure and terminal closures at two of the world’s busiest container ports, Ningbo and Yantian, caused months of disruption, knocking the highly synchronised global transport system out of rhythm.

Record vessel delays continue to clog ports and cram warehouses, with shippers competing to secure scarce space in aircraft and on container ships, while dealing with increasing freight rates, limited product availability and rising prices.

The queue of vessels anchored outside Los Angeles/Long Beach, the US gateway for Asian imports, has become a barometer of worldwide supply chain convulsions and the number of container ships waiting is consistently at a record high.

With around 22% of shipping capacity waiting to berth globally, sat outside LA/Long Beach, if that bottleneck could be resolved, it would release enough capacity for the rest of the system.

Supply chains could start to recover this year, particularly if inflation hits consumer confidence and the return of tourism, hospitality, rocketing fuel bills and higher-interest rates could all combine to weaken demand for goods, with some suggesting that shipping congestion could ease within weeks once consumers begin feeling the pinch.

China’s zero-risk COVID approach remains a significant concern for supply chains this year, as any new wave of coronavirus infections, could lead to factory and port closures, which would further disrupt shipping.

Whatever challenges this year may hold we will continue to power the supply chains of our customers, with effective freight management and close liaison with our origin teams, to create resilient, flexible supply chains.

The gauge of worldwide supply chain constraints produced by the Federal Reserve is based on 27 variables, including global shipping rates and air freight costs, which dipped slightly lower in November and December, even as many countries face rising cases of the Omicron coronavirus variant and persistently high inflation.

Some analysts believe that the squeeze in certain areas will continue to ease off in the coming months, with some supply chain disruptions resolving themselves, while others may prove more persistent.

Graph reproduced courtesy of the FT – View the original article HERE